Universal Basic Income (UBI) as a Policy Response to Current Challenges

SUMMARY:

There is growing concern that current US transfer and social welfare programs are ill-equipped to address widening income inequality, stagnant income growth, declining economic mobility, and the negative impact of automation. This has led to a renewed debate over the merits of a Universal Basic Income (UBI) program and its capacity to address these pressing issues.

Kearney and Mogstad argue that, in practice, a UBI would be an extremely expensive, inefficiently targeted, and potentially harmful policy that would solve none of the economic challenges it purports to address. First, a UBI that provided $10,000 a year to every American adult would cost more than half of the current annual federal budget. To fund such a program would require the crowd out of existing programs and potential investments. Second, since a UBI is not inherently designed to redistribute resources to the most needy individuals, moving from our current system to a UBI would redistribute resources away from those who are most likely to benefit from income support programs. And third, since a UBI lacks a direct mechanism to help workers learn new skills or broadly support the development of human capital in the U.S., it does not offer a long-term solution to the challenge of weakened employment prospects.

Kearney and Mogstad do not favor a UBI, but they do recommend improved and expanded government programs to expand economic opportunity and address income inequality. Specifically, they favor increased government funding for targeted investments that support families and workers, including early-childhood education, skills training, subsidized daycare and housing, and other initiatives.

KEY POINTS:

- The general premise of a UBI is to provide individuals with an unconditional income guarantee from the government regardless of personal circumstances or family income.

- A UBI is distinct from a NIT, or negative income tax, which would provide variable subsidies based on an individual’s current earnings to guarantee a minimum income level.

- Proponents of UBI offer a variety of motivations and arguments in support. Most proponents contend that the program could address rising income equality by offering a guaranteed level of income to all individuals. Some view UBI as an ideal tool insulate households from the impacts of globalization and technological innovation, including job loss. Others contend that a UBI would be more efficient than the existing complicated set of current transfer programs targeting different populations or types of need.

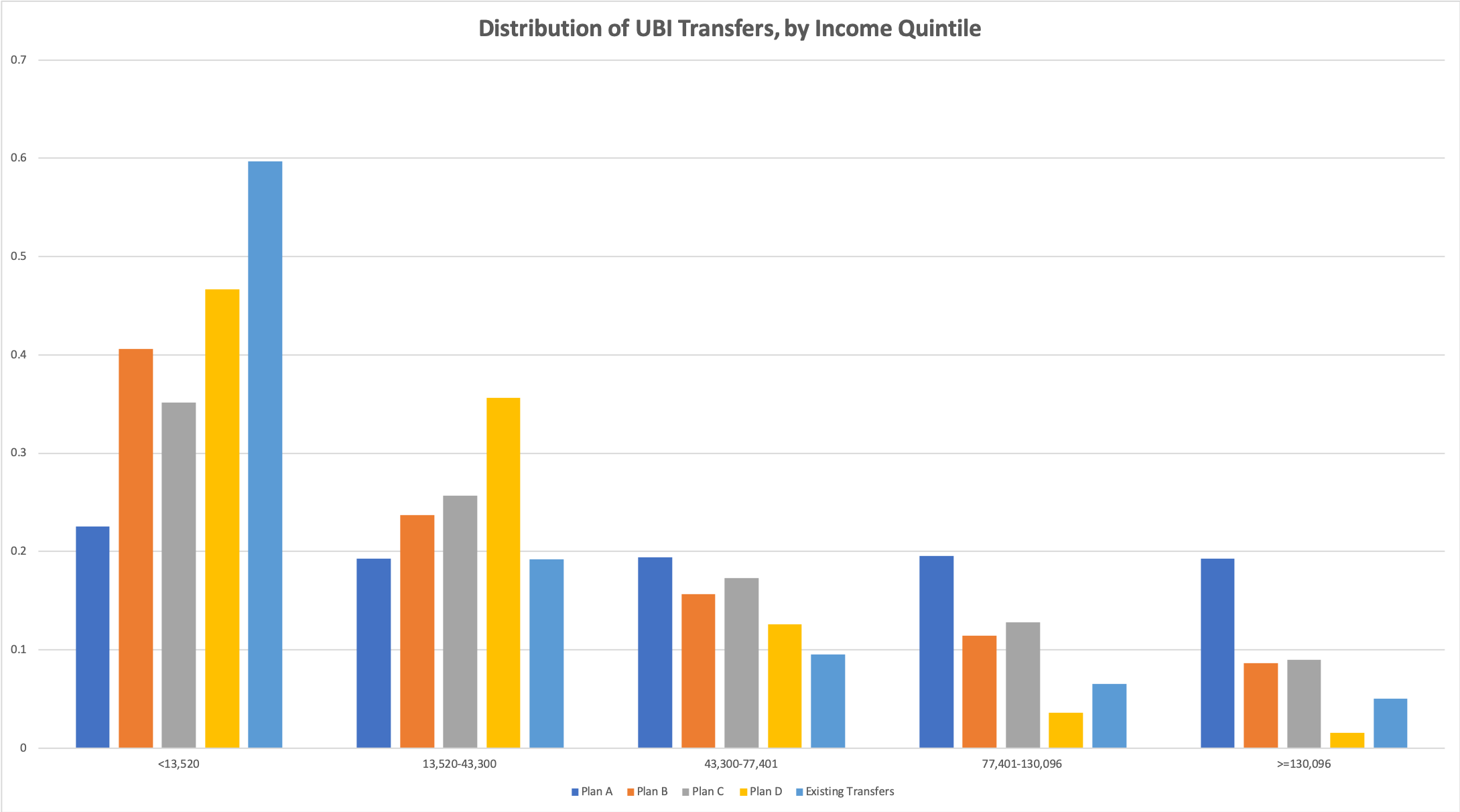

- Kearney and Mogstad argue that by purposefully spreading payments across the widest possible base – including (in many UBI proposals) middle- and upper-income individuals — the economically vulnerable would receive less support. As compared to existing programs, a UBI would transfer less to the elderly, disabled, and families with children and more to higher income able-bodied individuals. Even if UBI payments were phased out and capped for earners above a certain income, the program would still end up giving able-bodied working-age adults subsidies regardless of relative need.

- UBI’s are designed to not account for the elements of life that make families more or less in need of government support – such as having a child with a serious illness or a work-limiting disability oneself – and as such, would result in a highly inefficient allocation of resources.

- The authors argue that a UBI does nothing to address the root causes of declining employment and wages. Whereas a targeted wage subsidy would encourage work and increase take-home pay, a UBI would discourage labor supply and offers no direct assistance to less educated individuals grappling with the impact of automation.

AUTHOR RECOMMENDATIONS:

- The federal government should pursue a pro-work, pro-skills strategy of income support that includes wage subsidies to low-wage workers, as well as providing cash and near-cash benefits targeted to the neediest individuals and households with barriers to work.

- Wage subsidies like the Earned Income Tax Credit, which raise household income and are an effective tool to encourage labor force participation, should potentially be expanded.

- Policymakers should work to improve existing cash and near-cash programs to make them administratively less cumbersome. While there are legitimate criticisms of such programs, many existing programs are appropriately targeted to households in need of economic assistance, which in turn reduces the likelihood of wasteful spending.

- Direct more resources towards subsidized childcare and daycare, institutions of learning and training, and other programs that help people invest in their own human capital and advance they employment opportunities.