The Higher Wages Tax Credit

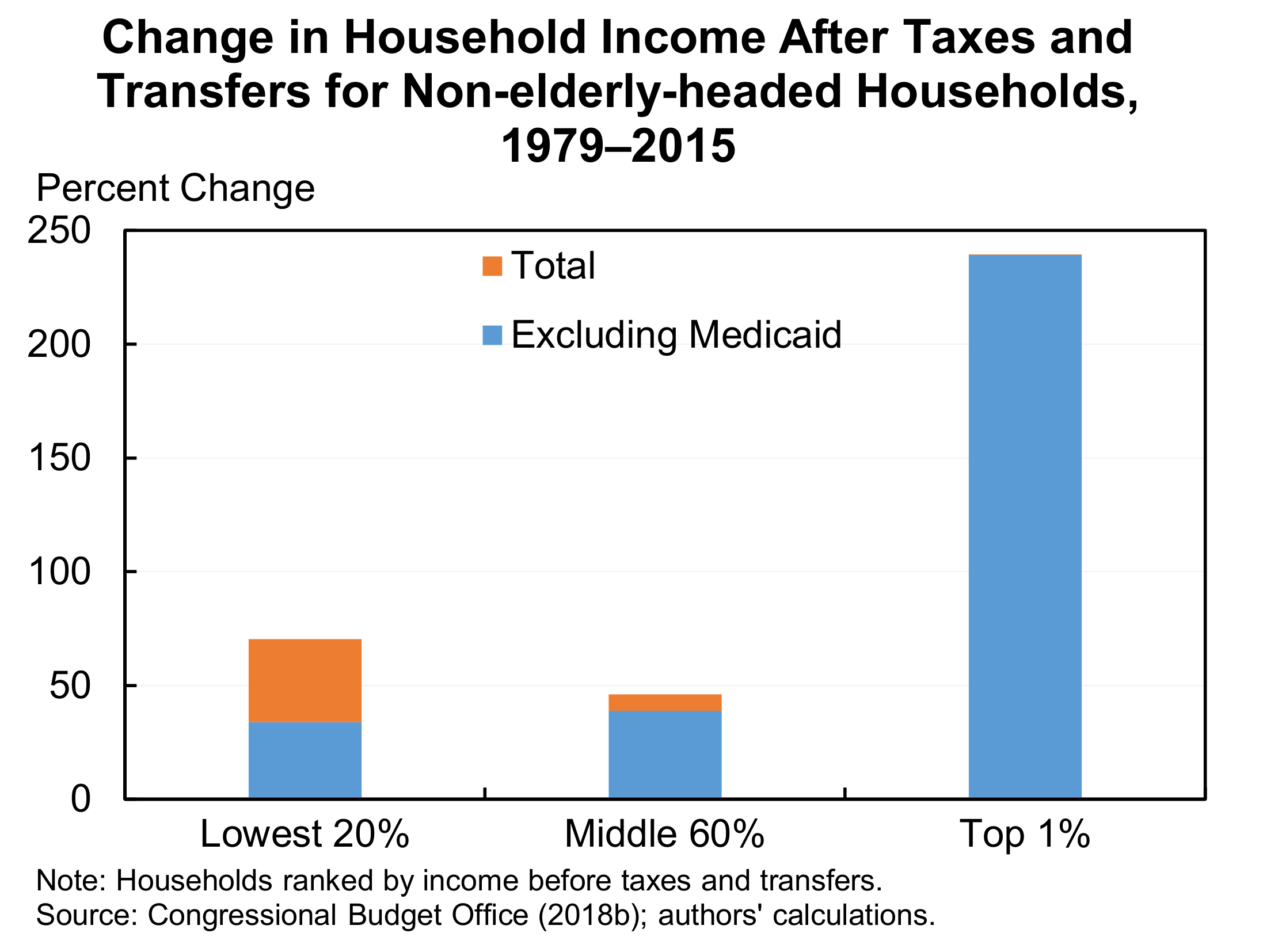

In the face of continued low employment, stagnant wages, persistent poverty, and rising inequality, minimum wage increases will likely continue to hold appeal as a policy response. In this chapter, I propose a Higher Wages Tax Credit (HWTC) to partially offset the costs imposed by minimum wage increases on firms that employ low-skilled labor. Following a minimum wage increase, the HWTC would provide a tax credit of 50% of the difference between the prior minimum wage and the new minimum wage, for each hour of labor employed; the credit would phase out at wages higher than the minimum wage, and as wage inflation erodes the real cost of higher nominal minimum wages. The HWTC would reduce the incentive for employers to substitute away from low-skilled workers in the face of minimum wage increases, thus mitigating the potential adverse effects of minimum wage increases while simultaneously preserving and possibly enhancing some of the benefits of minimum wage hikes. The credit is also intended to infuse the debate around increasing the minimum wage with a more realistic accounting of the costs and benefits of such a policy by partially transforming minimum wage increases into a more conventional redistributive policy.