May 2024 Jobs Report: Mixed Messages in the Job Market

The BLS estimated that the US economy added 272,000 jobs in February, with the unemployment rate ticking up from 3.9% to 4.0%. Three things stood out beneath the headlines of this report.

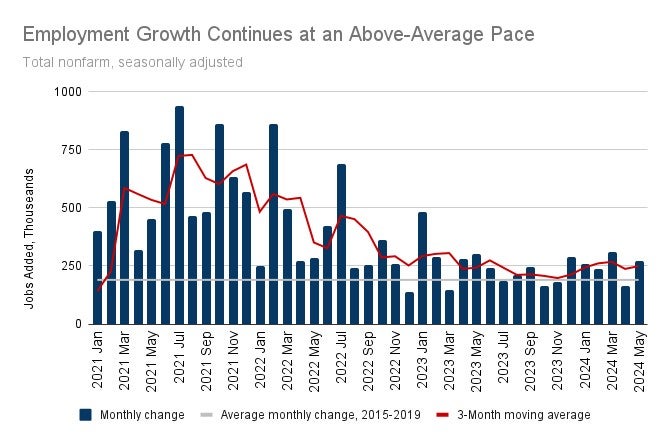

1. Job Growth Accelerates

Today’s estimate of 272,000 jobs added substantially beat the consensus market forecasts of 180,000, and by all measures is consistent with a strong and growing economy. The three-month average of 249,000 jobs added exceeds both the pre-pandemic average (190,000 jobs) and upper estimates of the pace needed to keep up with current population growth (230,000 jobs). Despite consistent expectations that employment growth will slow, this latest report is another sign that the momentum this job market has built over the past few years will not disappear quickly.

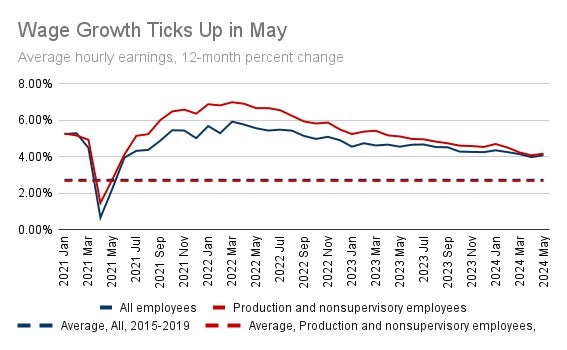

2. Wage Growth Ticks Up

As the job market continues to expand, firms increased wages faster than expected in May as well. Average hourly earnings for all workers grew by 4.1% over the past year, an uptick from the 3.9% rate of growth last month. This uptick is small in comparison to the large decline in wage growth we have seen since 2022 when pay was rising at a 5.9% pace. But the jump is also a sign that the job market is still strong and is driving pay increases that, in turn, are making it less likely inflation will quickly fall.

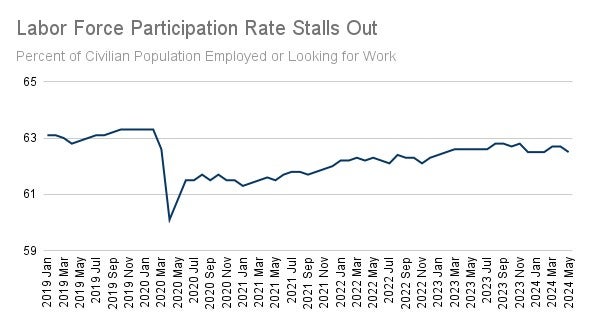

3. Unemployment Rises and Labor Force Participation Dips

Although the top-line estimates of employment and wage growth pointed to a still stronger-than-expected job market. The May jobs report did flash some warning signs that the job market may be slowing down. First, the unemployment rate hit 4% for the first time since January 2022, when it was falling from the pandemic-induced highs. This share of adults looking for work but unable to find a job has been slowly but steadily rising from the post-pandemic low of 3.4% in recent months. Second, the unemployment rate can sometimes rise for a good reason – because more adults start to look for work – but this was not one of those times. The labor force participation rate fell from 62.7% to 62.5% in May and has been stuck well below pre-pandemic levels for the past four years. These twin trends – of a smaller share of adults looking for work and, when they are, having a harder time finding jobs – will make it difficult for the economy to continue growing as quickly as it has recently.

What this means:

While this jobs report, on the net, came in stronger than expected, it was by no means a blockbuster report. Faster-than-expected job growth and wage growth demonstrate that the economy is not slowing at the pace many expected, but the uptick in the unemployment rate and continued stall-out in labor force participation are concerning signs that make clear the economy will not remain this strong indefinitely. If these trends continue, job market conditions will not prevent policymakers from lowering interest rates later this year.