May 2024 CPI Report: Can the US Economy Have it All?

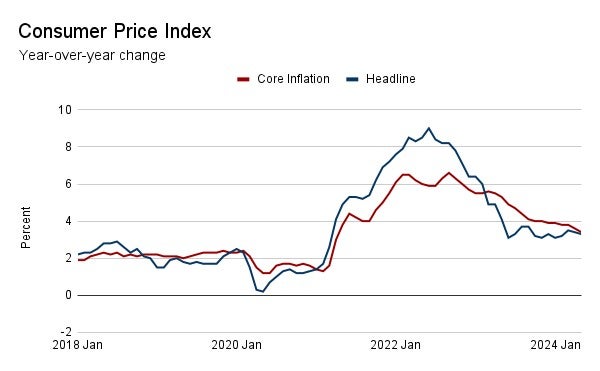

The Consumer Price Index rose at a 3.3% annual pace in May 2024, and 3.4% for all items excluding food and energy. Three things stood out from this report.

1. Inflation Softens More Than Expected

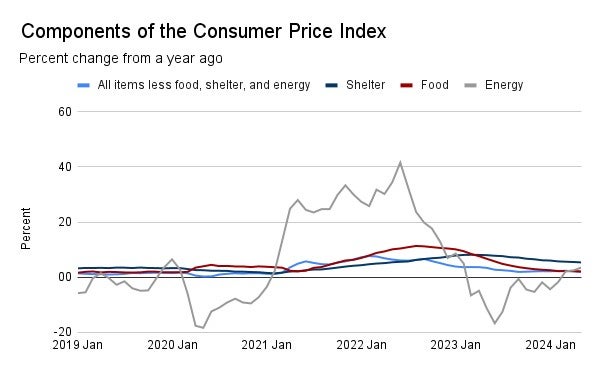

Overall, consumer prices were unchanged from April to May and rose by 3.3% over the past year. Core CPI, excluding volatile goods and energy prices, rose by 3.4%, the lowest level since April. Forecasters were expecting the total CPI to rise by 3.4%, but falling gas prices, which dipped by 3.6% over the past month, helped to push the price index down.

2. Housing Costs Keep Inflation Elevated

Declining gas prices helped to tamp down inflation in May, but still-rising housing costs are preventing a faster decline in the price index. Housing costs have been very slow to come down from their post-pandemic high, with the shelter component of the CPI rising by 5.4% since last May. Shelter makes up 36% of the total CPI, and high costs have played a large role in keeping inflation elevated. In May, shelter costs alone accounted for 57% of the rise in all prices over the past year.

3. Core Inflation Hits a Three-Year Low

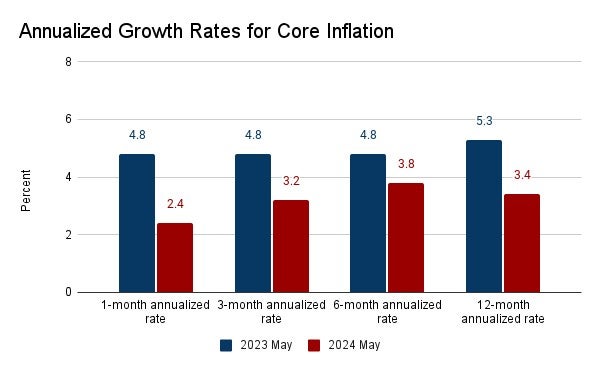

The 3.4% increase in prices outside of food and energy was the slowest pace in over three years. This core index is considered a reliable indicator of underlying trends in overall inflation, and May’s data marks the continuation of a slow but steady descent – this time last year, core prices were rising by 5.3%. Indeed, by more recent measures, core inflation is set for further improvements. Looking at the past three months, core inflation is trending at a 3.2% annual rate, and the annualized pace of this past month’s change is 2.4%.

What this means:

The May employment report’s larger-than-expected job growth and wage gains opened the question of how hot the US economy continues to run – and whether interest rate cuts amid such solid data are appropriate. But today’s CPI data send a strong signal that this economy can manage both strong job growth and falling inflation at the same time. While no single report should alter the outlook too much, May’s data should make policymakers much more confident inflation continues on the path back to their 2% target.