March 2024 Jobs Report: Three Things to Know

The BLS estimated that the US economy added 275,000 jobs in February, with the unemployment rate ticking up from 3.7% to 3.9%. Three things stood beneath the headlines of this report.

- Revisions Take Some Heat of the Economy

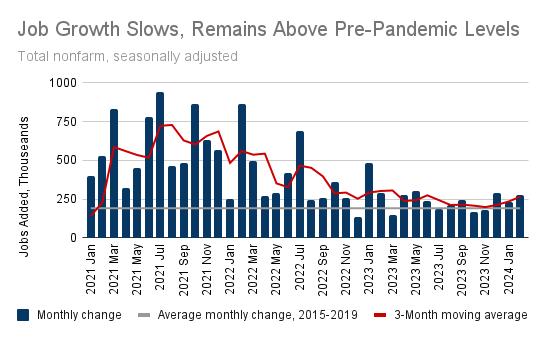

While the top-line number today beat the consensus market forecasts, the BLS also revised down their estimates for December and January by a combined 167,000 jobs. The estimated number of jobs added in January alone was revised down from 353,000 down to 229,000. While these monthly gains remain above pre-pandemic levels, indicating a labor market that has remained strong, they do not indicate the kind of blistering job growth last month’s report suggested.

- Wage Growth Resumed Its Steady Moderation

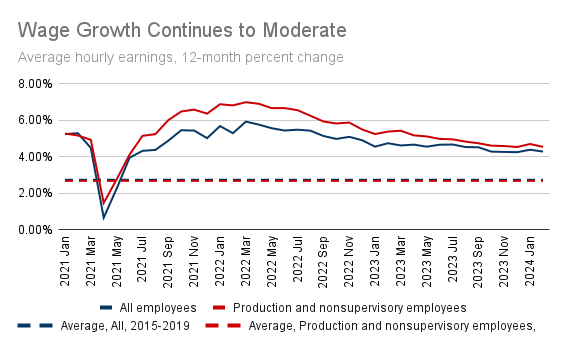

Average hourly earnings for all workers grew by 4.3% over the past year, down from it’s post-pandemic peak of 5.9% growth. Last month, wages ticked up by an unexpected 4.4%, stoking concerns that the still-hot economy was fueling wage growth that would, in turn, contribute to further inflation. While wage growth among all workers and among those in production and non-supervisory roles remains above the pre-pandemic average of 3%, the tick down this month signals a return in the trend of slower wage growth.

- Labor Force Participation Flatlines

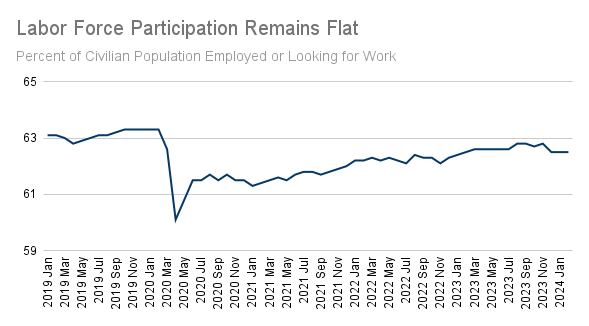

One concerning development in this report is the continued stallout in the rate of workers entering the labor force. The share of the population 16 or older that is either employed or looking for work has remained at 60.5% for the past three months, below the pre-pandemic rate (in January 2020) of 63.3%. While this lower rate is in part naturally due to the aging of the population, this lower share of adults in the labor force will contribute to a tight job market over the near term and the long term.

What this means:

The combination of slower job growth and slower wage growth in this month’s report strikes a solid balance between an economy that was overheating and one at risk of falling into recession. If last month’s jobs report brought a fresh wave of concern that the economy remained too hot for the Federal Reserve to consider lowering interest rates, this report should ease those fears. Just as analysts began to wonder if the still-hot economy would lead the Fed to hold off on any rate cuts in 2024, the data released today should bring the conversation back to when we will see the first cut in 2024, rather than if.