June 2024 CPI Report: The Summer Cooldown Continues

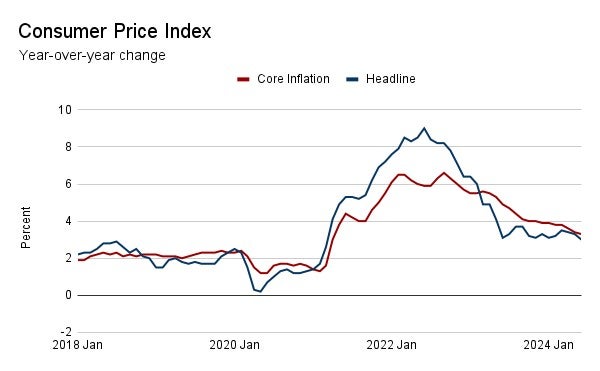

The Consumer Price Index rose at a 3.0% annual pace in June 2024, and 3.2% for all items excluding food and energy. Three things stood out from this report.

1. Core CPI Hits Lowest Level in Three Years

While markets expected a small increase in prices from May to June, the Consumer Price Index declined by -0.1%, and over the past year prices have risen by 3.0%. Among items in the core CPI, which excludes food and energy, prices rose by 0.2% since last month and by 3.3% over the past year. The 3.3% increase in the Core CPI is the smallest gain since April 2021.

2. Recent Trends Paint a More Encouraging Picture

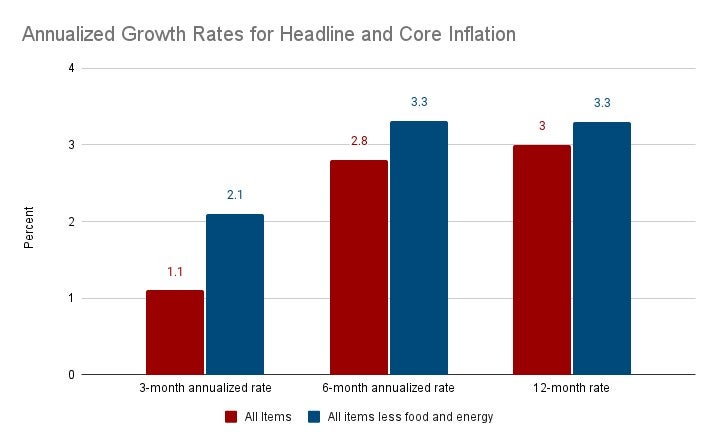

After inflation started this year much hotter than expected, prices in recent months have been falling steadily, and more frequent measures of inflation trends reflect this progress. Headline inflation fell to 3% in June, from a recent high of 3.5% in March. If price trends in the three months since March continue for 12 months, annual inflation would hit 1.1% – far below the Fed’s 2% inflation target. Core inflation, which is a more reliable indicator of underlying trends, shows similar progress: the past three months show annual inflation is trending just near target at 2.1%.

3. Declining Prices Have Been Broad-Based

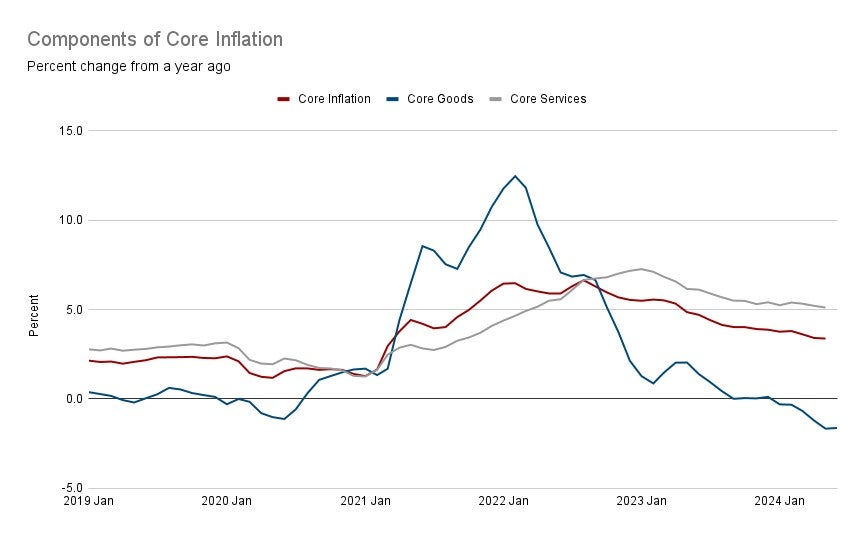

One of the most encouraging signs in today’s report was the decline across several groups within the Core CPI, suggesting this data represents the start of a sustained fall in inflation rather than a one-month blop. Within core goods, prices for used cars continue to fall, dropping by 1.5% since last month. WIthin services, airfare prices registered a 5% drop.Most notably, shelter prices rose by just 0.2% over the last month, the smallest increase in that category since August 2021.

What this means:

The June employment report indicated that the labor market is entering a new period of slower growth, and the inflation report for that month should lead to the same conclusion about prices. It has become clear by now that the uptick in inflation at the beginning of the year was more noise than signal, and data since March has shown prices getting back on their disinflationary track. Core inflation is now at its lowest level in three years and, if the last three months are an indication, is sitting right now just at the Fed’s target. Taking these inflation trends together with the slower pace of job growth and rising unemployment, the question now becomes whether this summer cooldown turns into a fall chill.