Eight Questions—and Some Answers—on the US Fiscal Situation

In this paper, Jason Furman addresses eight specific questions essential to understanding the US fiscal situation and what policymakers can do to address the federal debt. He finds that an adjustment of between 0.7 and 4.6 percent of GDP is necessary to stabilize the debt over the next decade, and he proposes a broad set of reforms to achieve such an adjustment, including tax reform, PAYGO conditions for new spending programs, and reforms to Social Security and Medicare.

In fiscal years 2022, 2023, and 2024, the US ran an average deficit of 6 percent of GDP, despite a strong economy. As a result, 2024 ended with the debt at about 99 percent of GDP, higher than it had been in any year except 1945 and 1946. The CBO expects the primary deficit (excluding interest payments on the debt) to improve over the next decade, but that development will be offset by higher interest rates leading to larger interest payments on the debt. In short, the fiscal path remains unsustainable: The federal deficit ranges from 6 to 10 percent of GDP, and the debt will likely reach between 111 and 141 percent of GDP by 2030.

Furman emphasizes that, while the “known knowns” of rising debt, such as crowding out of private investment, are not particularly large, the “unknown unknowns” are potentially much larger and even more consequential. For instance, there are growing concerns about whether the Treasury will have access to the necessary borrowing ability in the future, should debt levels rise acutely. Although the likelihood of a fiscal crisis may seem low, its potential consequences would be severe.

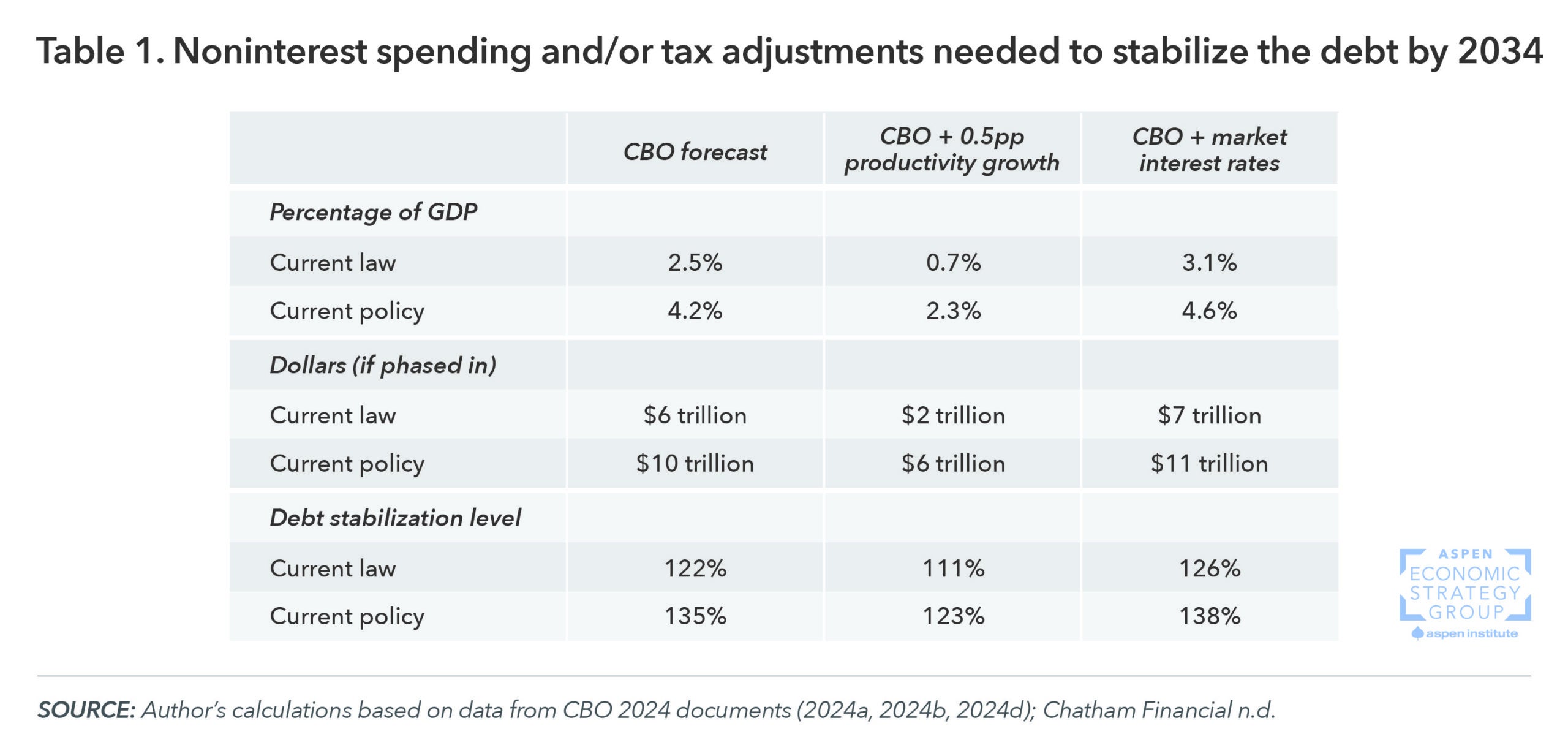

The estimated deficit reduction needed to stabilize the debt by 2034 depends on the path of policy and on economic variables, such as interest rates and productivity growth. Under the scenarios Furman explores in this paper, an adjustment of 0.7 and 4.6 percent of GDP in higher taxes or lower noninterest spending is necessary to stabilize debt over the next decade (equivalent to between $2 trillion and $11 trillion in adjustments).

Furman reviews the likely impact of a menu of possible tax and spending proposals, highlighting several key takeaways. First, revenue from corporations and high-income individuals is not sufficient to close the fiscal gap. For instance, such provisions in the Biden administration’s 2025 budget would raise about 1.3 percent of GDP in revenue. A more aggressive set of proposals would likely run into Laffer-curve constraints before revenues reached 2 percent of GDP.

Second, extending the 2017 tax cuts would add another 1.5 percent of GDP to the fiscal gap, substantially exacerbating the situation. Third, outside cuts to Social Security, not even relatively dramatic spending cuts in other programs would come close to reducing the deficit by even 1 percent of GDP. Finally, restoring solvency to Social Security and Medicare through tax or benefit changes would close about 1.5 percent of the current law deficit.

Policy Recommendations

Furman concludes by recommending that policymakers balance the primary budget, which excludes interest payments, by 2030. Achieving this goal would stabilize the debt at 125 percent of GDP and, under both CBO and market interest rate forecasts, would keep interest payments below 2 percent of GDP. Debt would then, in turn, start to gradually fall as a percent of GDP—which is essential, given that periodic emergencies (such as wars, financial crises, and pandemics) ratchet up the debt-to-GDP ratio.

To achieve this outcome, he proposes that policymakers undertake the following four measures:

- Do not pass any new tax legislation in 2025, unless it includes a reform plan that increases revenues by 0.5 percent of GDP relative to current law.

- Implement a Super PAYGO system for all future legislation, where savings would exceed costs by 25 percent.

- Reform Social Security and Medicare to ensure the trust funds’ solvency for the next 75 years.

- Allow for flexibility to address economic and international emergencies.

Suggested Citation: Furman, Jason., 2024. “Eight Questions—and Some Answers—on the US Fiscal Situation” In Strengthening America’s Economic Dynamism, edited by Melissa S. Kearney and Luke Pardue. Washington, DC: Aspen Institute. https://doi.org/10.5281/zenodo.14036808.