Causes, Consequences, and Policy Responses to Market Concentration

SUMMARY:

Measures of market concentration in many U.S. industries have been rising for nearly four decades. Since the early 2000s, these trends have coincided with a falling labor share of income, declining private investment, and rising corporate profit rates and markups (the difference between price and marginal cost). Philippon argues these patterns are unique to the United States; in Europe and Asia, profits, aggregate measures of concentration, and labor share of income have been stable over time.

Philippon acknowledges that increasing market concentration does not necessarily signal trouble for competitive markets. When producers in competitive markets drive down profit margins and out-compete inefficient rivals, market concentration will rise and will likely correspond to lower prices and higher productivity growth. However, market concentration can also increase when competition is being inhibited by lax antitrust enforcement or incumbent firm’s successful attempts to prevent challengers from entering the market. In this scenario, weakened competition would lead to growing market concentration, which would coincide with lower productivity growth and higher prices.

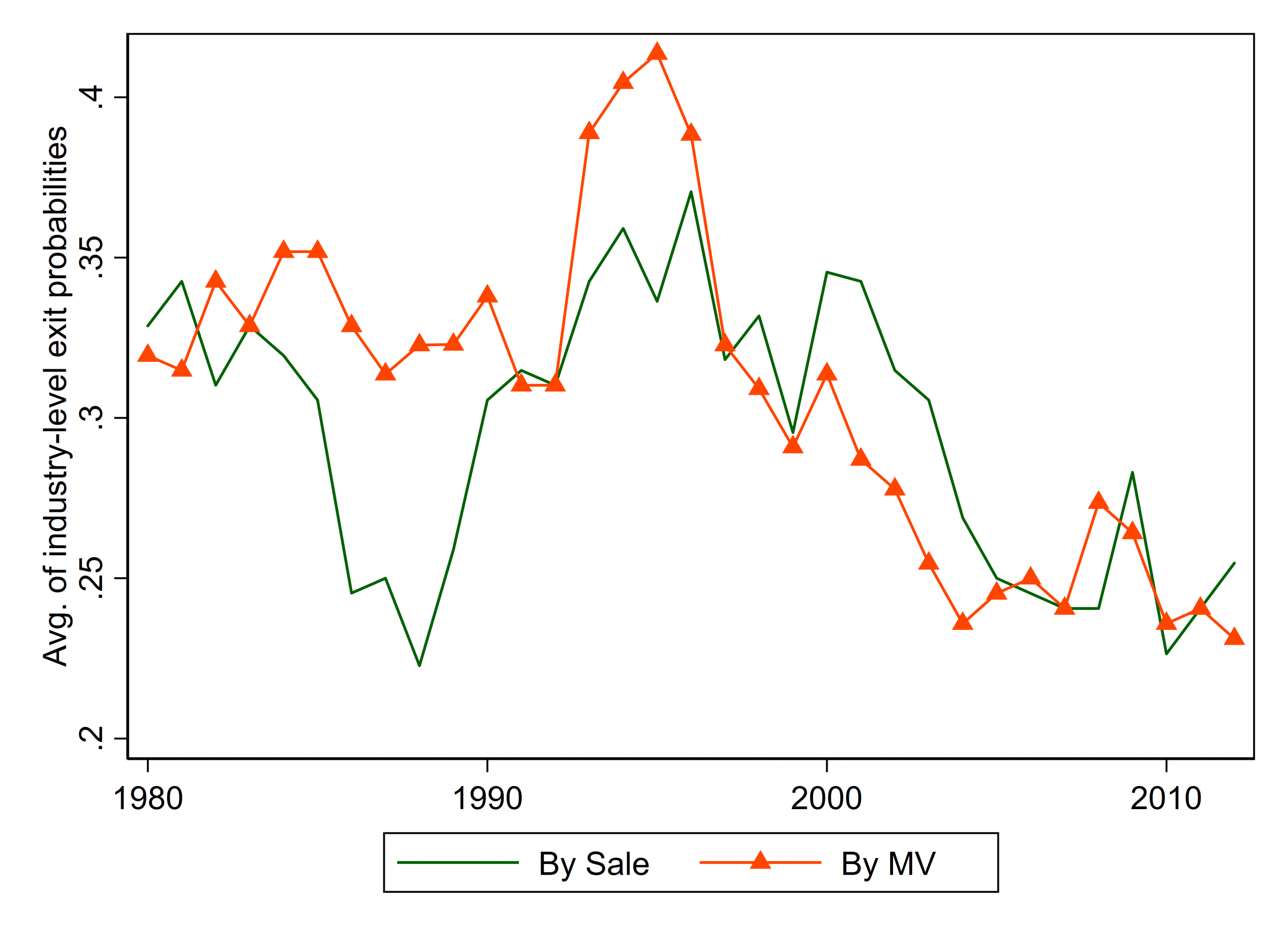

Philippon asserts that growth in aggregate measures of market concentration since the early 2000s is largely attributable to the weakening of competition. Lower levels of competition, Philippon argues, are directly due to lax antitrust enforcement and barriers to market entry. The likelihood of a market leader losing its superior position has fallen by 15 percentage points since the mid-1990s, lending support to Philippon’s argument that the market power of industry leaders has strengthened over this period.

KEY POINTS:

- Airlines and telecoms industries in the U.S. have become less competitive. Markups and concentration have risen in both sectors, and prices remain much higher relative to Europe, where competition policy is more robust. For example, the average monthly cost of fixed broadband was nearly twice as expensive in the U.S. ($68) compared to Europe, where costs ranged from $30 to $40 in most countries.

- Burdensome regulation is harming economic dynamism. As regulation becomes more stringent, firm start-ups in the U.S fall. This trend corresponds with the notion that market leaders are preventing competitors from entering the market.

- Counting only domestic firms in measures of market concentration can be misleading if those firms are exposed to foreign competition. However, after adjusting for trade, industries have still become more concentrated.

- The rise of intangible capital does not explain all of the decline in capital investment since 2000. Investment has been weak across all asset classes and intangible expenditures have increased across all advanced economies. However, profits have only increased in the U.S.

AUTHOR RECOMMENDATIONS:

- Reverse anticompetitive regulations at the state and federal level. For example, roll back occupational licensing or making licensing requirements transferable across states.

- Reinvigorate antitrust enforcement to promote competition, especially in the airlines and telecoms sector. Half of American households have only one internet provider option, while the other half have an average of only two. Antitrust enforcement should also block new mergers in this space.

- Across digital platforms, promote interoperability and data portability by allowing the exchange of information across platforms and enabling users to move their data across platforms.