April 2024 Jobs Report: A Best-Case Scenario for the Fed?

The BLS estimated that the US economy added 303,000 jobs in February, with the unemployment rate ticking down from 3.9% to 3.8%. Below are three key takeaways from this report – and what it means for interest rates.

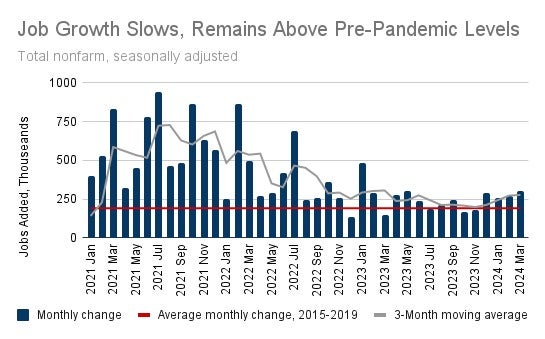

1. Job Growth Continues to Defy Expectations

Overall nonfarm employment grew by 303,000 in March, blowing past market expectations of 187,000 jobs added. The monthly gains over the first three months of 2024 have averaged 276,000 jobs, well above the 190,000 averaged before the pandemic. This strength has in part been driven by the recovery of two industries hard-hit by post-pandemic labor shortages: job growth in the Construction sector in March doubled its prior year’s average, and employment in Leisure and Hospitality has finally returned to its pre-pandemic level in February 2020.

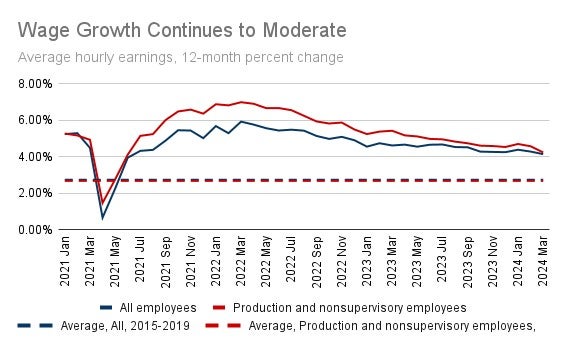

2. Wage Growth Slows, Despite Strong Employment

Yearly growth in workers’ average hourly earnings ticked down from 4.3% to 4.1% in March. While the top-line jobs number was much stronger than economists predicted, the slowdown in wage growth was in line with expectations. The continued moderation in wages growth should be the focus of attention in this report, as it continues to build the case that the economy can tolerate strong jobs growth without putting the Fed’s goal of bringing down inflation at risk.

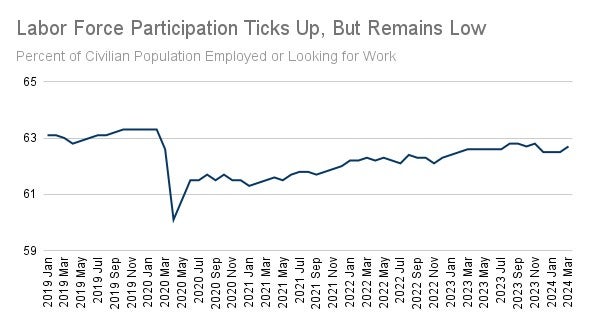

3. Labor Force Participation Flatlines

These twin dynamics of strong job growth with moderating wage gains were enabled by growth in the supply of workers in March. After three months at a standstill, the labor force participation rate – the share of adults employed or looking for work – ticked up from 62.5% to 62.7%. As potential workers come off the sidelines and look for work, businesses are able to add jobs without bidding up wages and fueling inflation. While the US economy is still a ways away from the 63.3% participation rate seen just before the pandemic, a further tick up next month would match the highest rate since 2020.

What this means:

This job report should not change the picture too much for policymakers with their eyes on a soft landing. In Chair Powell’s last press conference, he noted that strong job growth itself is not a reason to hold off on cutting interest rates, particularly if that strength comes from a further increase in labor supply – exactly the dynamic we see in this month’s report. Several more jobs reports similar to this one will continue to build the case for lowering interest rates later this year.