April 2024 CPI Report: A Step in the Right Direction

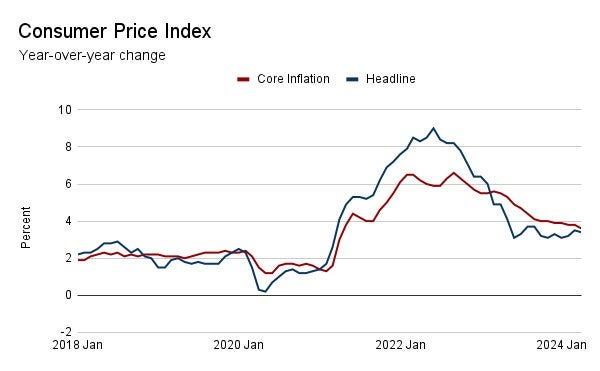

The Consumer Price Index rose at a 3.4% annual pace in April 2024, and 3.6% for all items excluding food and energy. Three things stood out from this report.

1. Inflation softens, after stickiness to start off the year

Annual inflation, as measured in the CPI, started the year near a post-COVID low of 3.1% in January – far below its peak of 9% in June 2022 but still above the Federal Reserve’s 2% target. The path back to 2% hit a snag over the past few months, however. creeping back up ultimately to 3.5% in March. The tick down in April offers a welcome sign that inflation may be returning to its downward trajectory.

2. Continued Price Declines for Big-Ticket Items are Driving Down Inflation

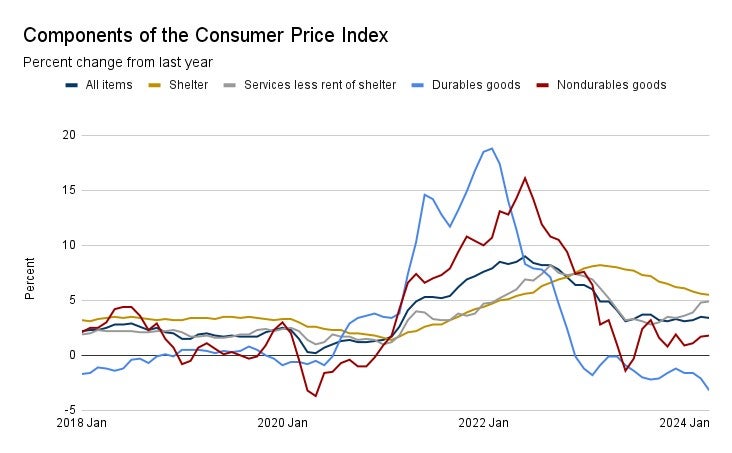

The tick down in inflation in April was driven largely by a sharp decline in prices for durable goods, such as cars and household appliances. Inflation in that category reached nearly 20% in 2022, as pandemic-related supply chain shortages caused prices to spike. As those disruptions have eased, prices for durable goods have consistently declined and fell by 3.2% over the past year in April. Prices for new and used vehicles alone have fallen by 0.6% over the past month.

3. While this decline is welcome, inflation is still running hot

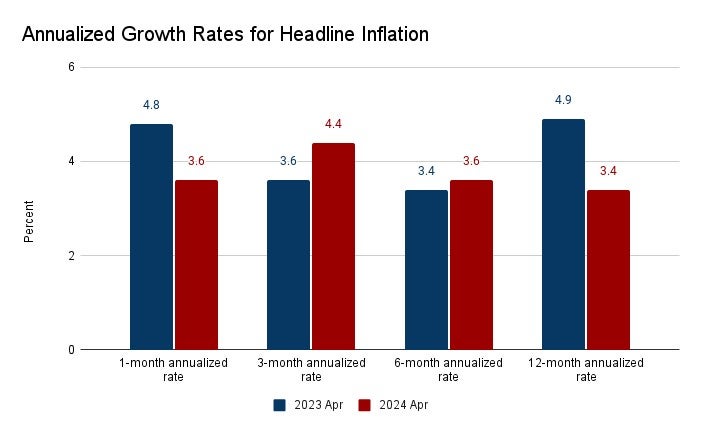

Inflation’s softening in April is a signal that the uptick over the previous few months may have come to an end. It will take more time, however, to get price increases closer to the Fed’s 2% target. If the pace of inflation over the last month – or over the past 6 months – continues over the year, inflation would still come in at 3.6%, indicating that the next few months whether the economy can get out of this holding pattern of lower, but not low enough, inflation.

What this means:

With the job market strong, but on a glide path toward normal levels, policymakers are focused on inflation as they gauge when to lower interest rates. April’s CPI report offers a solid step in the right direction — but only after these numbers veered sharply off-track to start off 2024. As the end of the year comes into sharper focus, the next two or three reports will be crucial. Several more readings like this will be needed to build greater confidence that inflation is moving sustainably to 2%.