Aspen Economic Strategy Group Welcomes New Members

Leading policymakers, business executives, and academics join bipartisan group dedicated to promoting evidence-based solutions to America’s economic challenges.

WASHINGTON, DC, MARCH 12, 2025 – The Aspen Economic Strategy Group (AESG) today announced that eleven new members have joined the bipartisan group of distinguished leaders and thinkers who are committed to promoting evidence-based solutions to significant challenges confronting the American economy. Established in 2017 and co-chaired by former U.S. Secretaries of the Treasury Henry M. Paulson, Jr. and Timothy F. Geithner, the AESG fosters the exchange of economic policy ideas and promotes bipartisan relationship-building among current and future generations of economic policy leaders.

New members include:

Kenneth I. Chenault, Chairman and Managing Director, General Catalyst; former Chairman and CEO, American Express

Rahm Emanuel, Senior Advisor, Centerview Partners; Former United States Ambassador to Japan

Mellody Hobson, Co-CEO and President, Ariel Investments

Jonathan Levin, President, Stanford University

Joseph Manchin III, former United States Senator from West Virginia

Kevin McCarthy, 55th Speaker of the United States House of Representatives

Steven Mnuchin, Founder and Managing Partner, Liberty Strategic Capital; 77th United States Secretary of the Treasury

Gina Raimondo, Distinguished Fellow, Council on Foreign Relations; 40th United States Secretary of Commerce

John Waldron, President and Chief Operating Officer, The Goldman Sachs Group, Inc.

Meg Whitman, United States Ambassador to Kenya (Ret.); Former CEO, Hewlett-Packard; Former CEO, eBay Inc.

Heidi Williams, Orville E. Dryfoos Professor in Economics and Public Affairs, Dartmouth College

The AESG is also pleased to welcome back three members who recently concluded their public service in the Biden administration:

Wally Adeyemo, Former Deputy Secretary, United States Department of the Treasury

John Podesta, Founder, Center for American Progress

Janet L. Yellen, 78th United States Secretary of the Treasury

“The United States is in the midst of a significant reconsideration of our nation’s approach to both domestic and international economic policy. This makes the commitment shared among AESG members to advancing evidence-based, bipartisan solutions to economic challenges more important than ever,” said AESG Director Melissa S. Kearney. “These new and returning members will bring valuable expertise and perspectives to the AESG.”

The full list of 2025 AESG members can be viewed here. Membership is capped at 65 members annually, and the list of AESG alumni includes many prominent economic and business leaders.

New and Returning Member Biographies:

Wally Adeyemo, Former Deputy Secretary, United States Department of the Treasury

Wally Adeyemo served as the 15th Deputy Secretary of the U.S. Department of the Treasury and chief operating officer of the 100,000 employee Department during the Biden Administration. Adeyemo led Treasury’s national security and economic inequality work, and implemented some of the Department’s top policy priorities. Adeyemo oversaw the Treasury Department’s use of economic tools in service of protecting U.S. national security, including financial sanctions and the work of the Committee on Foreign Investment in the United States. He led the Treasury Department’s comprehensive review on the effectiveness of sanctions as a national security tool. Adeyemo was the primary driver of the Administration’s approach to considering the national security implications of foreign direct investment. He also managed Treasury’s implementation of the Inflation Reduction Act, which was the most significant investment in the economy, energy security, and climate change in a generation, as well as the most significant effort in decades to modernize the Internal Revenue Service. Prior to his appointment as Deputy Treasury Secretary, Adeyemo served as President of the Barack Obama Foundation in Chicago, IL. During the Obama Administration, he served as Deputy National Security Advisor for International Economics and Deputy Director of the National Economic Council at the White House. Adeyemo is a member of the Council on Foreign Relations and the Aspen Economic Strategy Group. He was previously a board member of Demos, a New York-based think tank focused on social, political and economic equity issues, and a senior advisor at the Center for Strategic and International Studies and at Blackrock.

Kenneth I. Chenault, Chairman and Managing Director, General Catalyst; former Chairman and CEO, American Express

Ken Chenault is the Chairman and a Managing Director of General Catalyst. Prior to joining General Catalyst, Ken was Chairman and Chief Executive Officer of American Express, a position he held from 2001 – 2018. Upon Ken’s retirement from American Express, Warren Buffett, the company’s largest shareholder stated, “Ken’s been the gold standard for corporate leadership and the benchmark that I measure others against. ” At General Catalyst, Ken focuses on investing in fast-growing companies that have the potential to become large, fundamental institutions. He also provides invaluable guidance to portfolio companies, particularly to those with an eye towards global markets and responsible innovation, as they scale their teams and products. Ken is recognized as one of the business world’s experts on brands and brand management. He has been honored by multiple publications including Fortune Magazine, which named him as one of the World’s 50 Greatest Leaders in its inaugural list in 2014 and, most recently, in 2021. TIME celebrated Ken together with Ken Frazier in the TIME100 Most Influential People of 2021 list for their corporate and social activism; specifically, for mobilizing hundreds of corporate leaders to advocate for equitable voting rights in the U.S., and for co-founding OneTen, a coalition of leading organizations committed to upskilling, hiring, and promoting people without four-year degrees into family-sustaining jobs. Ken serves on the boards of Airbnb, Berkshire Hathaway, Bilt Rewards, Chief, Guild Education, and the Harvard Corporation. He also serves on the boards of numerous nonprofit organizations, including the Smithsonian Institution’s Advisory Council for the National Museum of African American History and Culture.

Rahm Emanuel, Senior Advisor, Centerview Partners; Former United States Ambassador to Japan

Rahm Emanuel was confirmed in a bipartisan vote as the 31st United States Ambassador to Japan on December 18, 2021. Previously, Ambassador Emanuel was the 55th Mayor of the City of Chicago, a position he held until May 2019. During that time, he made the critical choices necessary to secure Chicago’s future as a global capital. Prior to becoming Mayor, from November 2008 until October 2010, Ambassador Emanuel served as President Barack Obama’s Chief of Staff. In addition to being the President’s top advisor, the Ambassador helped the Obama administration secure the passage of the American Recovery and Reinvestment Act of 2009 and the landmark Patient Protection and Affordable Care Act. Ambassador Emanuel was elected four times as a Member of the U.S. House of Representatives from Illinois’s 5th Congressional District (2002-2008). As Chairman of the House Democratic Caucus, Emanuel helped pass legislation to raise the minimum wage and authored the Great Lakes Restoration Act. From 1993 to 1998, Ambassador Emanuel was a key member of President Bill Clinton’s administration, rising to serve as Senior Advisor to the President for Policy and Politics. During this time, Emanuel served as a legislative liaison to Congress and spearheaded efforts to pass several of President Clinton’s signature achievements, most notably the Federal Assault Weapons Ban, the Brady Handgun Violence Prevention Act, and the historic Balanced Budget Act, which created the Children’s Health Insurance Program that expanded health care coverage to 10 million children. The Ambassador also worked closely with President Joseph R. Biden Jr., then a U.S. Senator, to shepherd the Violence Against Women Act of 1994 through Congress. As a Senior Advisor at Centerview Partners and former Managing Director at Wasserstein Perella & Co., Emanuel brings a depth of financial experience to the post. Ambassador Emanuel graduated from Sarah Lawrence College in 1981 and received a Master’s Degree in Speech and Communication from Northwestern University in 1985. He is married to Amy Rule, and they have three children.

Mellody Hobson, Co-CEO and President, Ariel Investments

As Co-CEO, Mellody is responsible for management, strategic planning and growth for all areas of Ariel. Additionally, she chairs the board of Ariel Investments’ publicly traded mutual funds. Prior to being named Co-CEO, Mellody spent nearly two decades as Ariel’s President. In 2025, she founded Project Level® to change the game in women’s sports. Mellody co-founded Ariel Alternatives, LLC in 2021 and its inaugural private equity fund, Project Black® to scale minority-owned businesses. Beyond Ariel, she serves as a director of JPMorgan Chase and is the former chairman of Starbucks Corporation. Mellody was a long-standing board member of the Estée Lauder Companies and former board chair of DreamWorks Animation, overseeing the company’s sale in 2016. She is deeply committed to philanthropy and is a well-known advocate of financial literacy. Mellody published a New York Times bestselling children’s book, Priceless Facts about Money. She earned her AB from Princeton University’s School of Public and International Affairs.

Jonathan Levin, President, Stanford University

Jonathan Levin became Stanford University’s thirteenth president on August 1, 2024. Levin previously served as the Philip H. Knight Professor and Dean of Stanford Graduate School of Business from 2016 to 2024 and as chair of Stanford’s department of economics from 2011 to 2014. A leading economist, he is widely recognized for his scholarship in industrial organization and market design. President Levin’s scholarly work has spanned topics ranging from incentive contracts to game theory, e-commerce, and health insurance. He has conducted influential research on the organization and design of markets, subprime lending, and empirical methods to study imperfect competition. In 2011, he received the John Bates Clark Medal as the economist under the age of 40 who has made the most significant contribution to economic thought and knowledge. Levin is a fellow of the American Academy of Arts and Sciences, a former Guggenheim Fellow, and a recipient of department and school awards for distinguished teaching. In September 2016, Levin became the tenth dean of the Stanford Graduate School of Business. Under his leadership, Stanford GSB strengthened its position as the preeminent institution of management research and education. The school invested in new research programs, reimagined and significantly increased financial aid, expanded online and global programs, introduced classes for Stanford undergraduates, and developed ambitious collaborations focused on technology, sustainability, and other critical issues for business and society. From 2021 to 2025, Levin served as a member of President Biden’s Council of Advisors on Science and Technology. He is a Trustee of the Gordon and Betty Moore Foundation. He has consulted widely in industry and government. He was part of the international expert group that designed the first vaccine Advance Market Commitment for pneumococcal disease and participated in the design of the FCC’s noted broadcast spectrum incentive auction.

Joseph Manchin III, Former United States Senator from West Virginia

Joseph Manchin III served as a United States Senator for West Virginia from 2010 to 2025, bringing decades of leadership and a commitment to pragmatic, results-driven public service. Throughout his tenure, he was a key member of the Senate Energy and Natural Resources Committee, where he served as Chair, as well as the Appropriations, Armed Services, and Veterans’ Affairs Committees. Prior to his time in the Senate, he served as the 34th Governor of West Virginia (2005-2010) and as West Virginia Secretary of State (2001-2005). A staunch advocate for bipartisanship and commonsense policymaking, Senator Manchin focused on energy security, economic development, and national defense. He championed an all-of-the-above energy strategy that harnessed coal, natural gas, nuclear, and renewables, while emphasizing innovation and sustainability to ensure both environmental and economic stability. His leadership helped shape policies that strengthened American energy independence, revitalized domestic manufacturing, and supported job creation in West Virginia and beyond. Beyond public office, Senator Manchin remains deeply committed to his home state, supporting education, workforce development, and civic engagement initiatives. He continues to advocate for responsible governance, fiscal accountability, and solutions that bridge the partisan divide. A graduate of West Virginia University with a degree in business administration, he has dedicated his life to fostering economic growth and ensuring that the American Dream remains within reach for future generations.

Kevin McCarthy, 55th Speaker of the United States House of Representatives

Kevin McCarthy is the 55th Speaker of the House. Described as a man who exudes “true American grit,” McCarthy’s political journey is the quintessential American story. After starting a small business at the age of 21, McCarthy went back to college to earn his bachelor and master degrees in business. He was rejected for an internship to the congressional seat he later held for seventeen years. McCarthy won the Speakership after a historic 15 ballots, and went on to secure $2 trillion in deficit reduction, all while protecting the full faith and credit of the United States, keeping our government open, and making sure our troops were paid. He also refocused Congress on America’s long-term challenges by creating the first-ever Select Committee on the Chinese Communist Party. Throughout his career, McCarthy fought for a more effective, efficient, and accountable federal government. He also personally recruited and actively supported commonsense candidates for office who have helped reshape the Republican Party – several of whom have become Senators, Governors, and cabinet secretaries. Overall, under his leadership, dozens of new Republican women, minorities, and veterans have been elected to Congress. In Congress, he held nearly every elected leadership position in the House Republican conference and served under three Presidents, during two economic crises, and through consistent political upheaval while always maintaining his approach to governing as a Happy Warrior. McCarthy currently serves as Founder and Chairman of ALFA Institute, a policy think tank to advance America’s global position in the next technological space race of artificial intelligence, advanced defense and aerospace technology, energy and critical mineral resources, and next-generation bio and health advances. McCarthy also serves as Chairman of Watchtower Strategies, a public affairs firm focused on corporate strategic and crisis communications.

Steven Mnuchin, Founder and Managing Partner, Liberty Strategic Capital; 77th United States Secretary of the Treasury

Former Secretary Steven T. Mnuchin serves as the Founder and Managing Partner of Liberty Strategic Capital and chairs the firm’s Investment Committee. Liberty Strategic Capital is a Washington, D.C.-based private equity firm focused on strategic investments in technology, financial services and fintech, and new forms of content. Former Secretary Mnuchin currently serves on the boards of directors of Liberty Strategic Capital portfolio companies New York Flagstar Financial, Inc. (since 2024), Zimperium, Inc. (since 2022) and Cybereason Inc. (since 2021), and previously served on the boards of directors of Contrast Security, Inc. (2022-23) and BlueVoyant, Inc. (2022-23). Prior to founding Liberty, Mr. Mnuchin served as the 77th Secretary of the Treasury from February 2017 through January 2021. As Secretary of the Treasury, Mr. Mnuchin was responsible for leading the U.S. Treasury, whose mission is to maintain a strong economy, foster economic growth, and create job opportunities by promoting the conditions that enable prosperity at home and abroad. He was also responsible for strengthening national security by combating economic threats and protecting the U.S. financial system, as well as managing the U.S. Government’s finances. Mr. Mnuchin also oversaw cybersecurity for the financial services sector and all U.S. Treasury bureaus, including the IRS. Former Secretary Mnuchin played a pivotal role in advancing the President’s economic agenda, including the passage and implementation of the Tax Cuts and JOBS Act and the CARES Act. He also led the U.S. Treasury Department’s regulatory reform efforts. Former Secretary Mnuchin was chair of the Committee on Foreign Investment in the United States (CFIUS) and was a member of the National Security Council. He was responsible for using economic tools to combat terrorist financing and other threats to the United States and its allies. Prior to his confirmation, he served as Founder, Chairman, and Chief Executive Officer of Dune Capital Management. He founded OneWest Bank Group LLC and served as its Chairman and Chief Executive Officer until its sale to CIT Group Inc. Earlier in his career, former Secretary Mnuchin worked at The Goldman Sachs Group, Inc., where he was a Partner and served as Chief Information Officer, with responsibility for the firm’s global information and technology strategy and operations. He has extensive experience in global financial markets and investments. Former Secretary Mnuchin is committed to philanthropic activities and previously served as a member of the boards of directors of the Museum of Contemporary Art Los Angeles (MOCA), the Whitney Museum of Art, the Hirshhorn Museum and Sculpture Garden on the National Mall, the UCLA Health System, the New York Presbyterian Hospital, and the Los Angeles Police Foundation. He was born and raised in New York City and holds a B.A. from Yale University.

John Podesta, Founder, Center for American Progress

John Podesta is the Founder and served as Chair for the Washington, D.C.-based think tank Center for American Progress and a Founder and Chair of the Washington Center for Equitable Growth. Podesta served as Senior Advisor to President Joe Biden and counselor to President Barack Obama, where he was responsible for coordinating the administrations’ climate policy and initiatives. In 2008, he served as co-chair of President Obama’s transition team, where he coordinated the priorities of the incoming administration’s agenda and spearheaded its appointments of cabinet secretaries and senior political appointees. Podesta served as White House Chief of Staff to President William J. Clinton, where he was a member of the president’s cabinet and served on the National Security Council. Additionally, Podesta has held numerous positions on Capitol Hill, including counselor to Democratic Leader Sen. Thomas A. Daschle (1995-1996) and served on the President’s Global Development Council and the UN Secretary General’s High-Level Panel of Eminent Persons on the Post-2015 Development Agenda. In 2016, Podesta chaired Hillary Clinton’s campaign for president. A Chicago native, Podesta is a graduate of Knox College and the Georgetown University Law Center, where he is currently a visiting professor of law. He is the author of The Power of Progress: How America’s Progressives Can (Once Again) Save Our Economy, Our Climate and Our Country.

Gina Raimondo, Distinguished Fellow, Council on Foreign Relations; 40th United States Secretary of Commerce

Gina M. Raimondo is a distinguished fellow at the Council on Foreign Relations (CFR). From March 2021 through January 2025 she was the United States Secretary of Commerce. Under her leadership, the Department of Commerce made historic investments in Internet access, manufacturing, economic development, workforce training, supply chain resiliency, and climate readiness through the implementation of the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act. Raimondo was the seventy-fifth governor of Rhode Island and its first woman governor. As governor, she kick-started the state’s economy and made record investments in infrastructure, education, and job training by focusing on creating economic opportunities and good-paying jobs for all Rhode Islanders. She also served as the Chair of the Democratic Governors Association (DGA). During her term, she rebuilt the entire DGA leadership team, bolstered the fundraising, communications, and research teams, and grew the digital program exponentially. Raimondo earned her BA in economics from Harvard University and a PhD from Oxford University through a Rhodes Scholarship. She is a graduate of Yale Law School and clerked for U.S. District Judge Kimba Wood. The 2016 recipient of Yale Law School’s prestigious Alumni Award of Merit, Secretary Raimondo is an alumni fellow on the Yale Board of Trustees. She is a member of the Council of Foreign Relations.

John Waldron, President and Chief Operating Officer, The Goldman Sachs Group, Inc.

John Waldron is president and chief operating officer and a member of the Board of Directors of the Goldman Sachs Group, Inc. He is a member of the Goldman Sachs Management Committee, co-chair of the Firmwide Enterprise Risk Committee, and chair of the Firmwide Reputational Risk Committee. John is a member of the Executive Committee of the Institute of International Finance, a member of the International Advisory Council of the China Securities Regulatory Commission, a member of the US-China Business Council and a member of the International Advisory Panel of the Monetary Authority of Singapore. In addition, John is a member of the Board of Directors of the Cleveland Clinic, a member of the Board of Directors of Lincoln Center for the Performing Arts in New York City, a member of the Board of Trustees of Middlebury College, a member of the Board of Trustees of Southern Methodist University and a member of the Council on Foreign Relations. John graduated Phi Beta Kappa from Middlebury College with a BA in English in 1992.

Meg Whitman, United States Ambassador to Kenya (Ret.); Former CEO, Hewlett-Packard; Former CEO, eBay Inc.

Meg Whitman was confirmed in a unanimous vote by the U.S. Senate as the eighteenth United States Ambassador to Kenya on July 14, 2022. In Kenya she focused on accelerating economic growth and development, forged new conservation initiatives, supported good governance and democratic principles and oversaw significant humanitarian assistance. She returned home in December 2024 with the change in U.S. administration. Ambassador Whitman has significant experience leading business organizations, from start-ups to large multinational companies in Silicon Valley. She has served as the President and CEO of Hewlett Packard Enterprise and the Hewlett-Packard Company, both multinational information technology companies. She also served as President and CEO of eBay Inc, an online marketplace and digital payments company. Ms. Whitman has also been a member of numerous corporate boards of directors, including those of Procter & Gamble and General Motors. Committed to equality in education and protection of the environment, Ambassador Whitman has been National Board Chair of Teach For America and a Member of the Board of Trustees of The Nature Conservancy. Ambassador Whitman is married to Dr. Griffith Harsh, a neurosurgeon. They have two grown sons and three grandchildren. Whitman holds an MBA from Harvard Business School and an AB in Economics from Princeton University.

Heidi Williams, Orville E. Dryfoos Professor in Economics and Public Affairs, Dartmouth College

Heidi Williams is the Orville E. Dryfoos Professor in Economics and Public Affairs at Dartmouth College. She is currently lead editor of the Journal of Economic Perspectives, and works part-time at the Congressional Budget Office. Together with Ben Jones, Heidi co-directs the National Bureau of Economic Research Innovation Policy working group. She is also Director of Science Policy at the Institute for Progress and a nonresident senior fellow at the Hutchins Center on Fiscal and Monetary Policy at Brookings. Heidi received her AB in mathematics from Dartmouth College in 2003, her MSc in development economics from Oxford University in 2004, and her PhD in economics from Harvard in 2010. She is a Fellow of the American Academy of Arts and Sciences and of the Econometric Society, and is the recipient of a MacArthur Foundation Fellowship (2015).

Janet L. Yellen, 78th United States Secretary of the Treasury

Janet L. Yellen served as the 78th Secretary of the United States Treasury from 2021 through 2025. Previously, she was a Distinguished Fellow in Residence with the Economic Studies Program at the Brookings Institution and former chair of the Federal Reserve Board. Yellen also served as vice chair of the Federal Reserve Board, president and chief executive officer of the Federal Reserve Bank of San Francisco, as well as chair of the White House Council of Economic Advisers. Yellen is professor emerita at the University of California–Berkeley where she was the Eugene E. and Catherine M. Trefethen Professor of Business and Professor of Economics and has been a faculty member since 1980. In 2012, Yellen was appointed distinguished fellow of the American Economic Association. She served as President of the American Economic Association in 2020. Yellen is a member of the American Academy of Arts and Sciences, the Council on Foreign Relations, and the Economic Strategy Group of the Aspen Institute. Yellen graduated summa cum laude from Brown University with a degree in economics in 1967 and received her Ph.D. in economics from Yale University in 1971. Yale awarded Yellen the Wilbur Cross Medal in 1997. In 1998, Brown awarded her an Honorary Doctor of Laws degree. She has also received honorary degrees from Bard College, NYU, the London School of Economics and Political Science, the University of Warwick, Yale, the University of Michigan and the University of Pennsylvania. Her scholarship has covered a range of macroeconomic issues, with a special focus on the causes, mechanisms, and implications of unemployment.

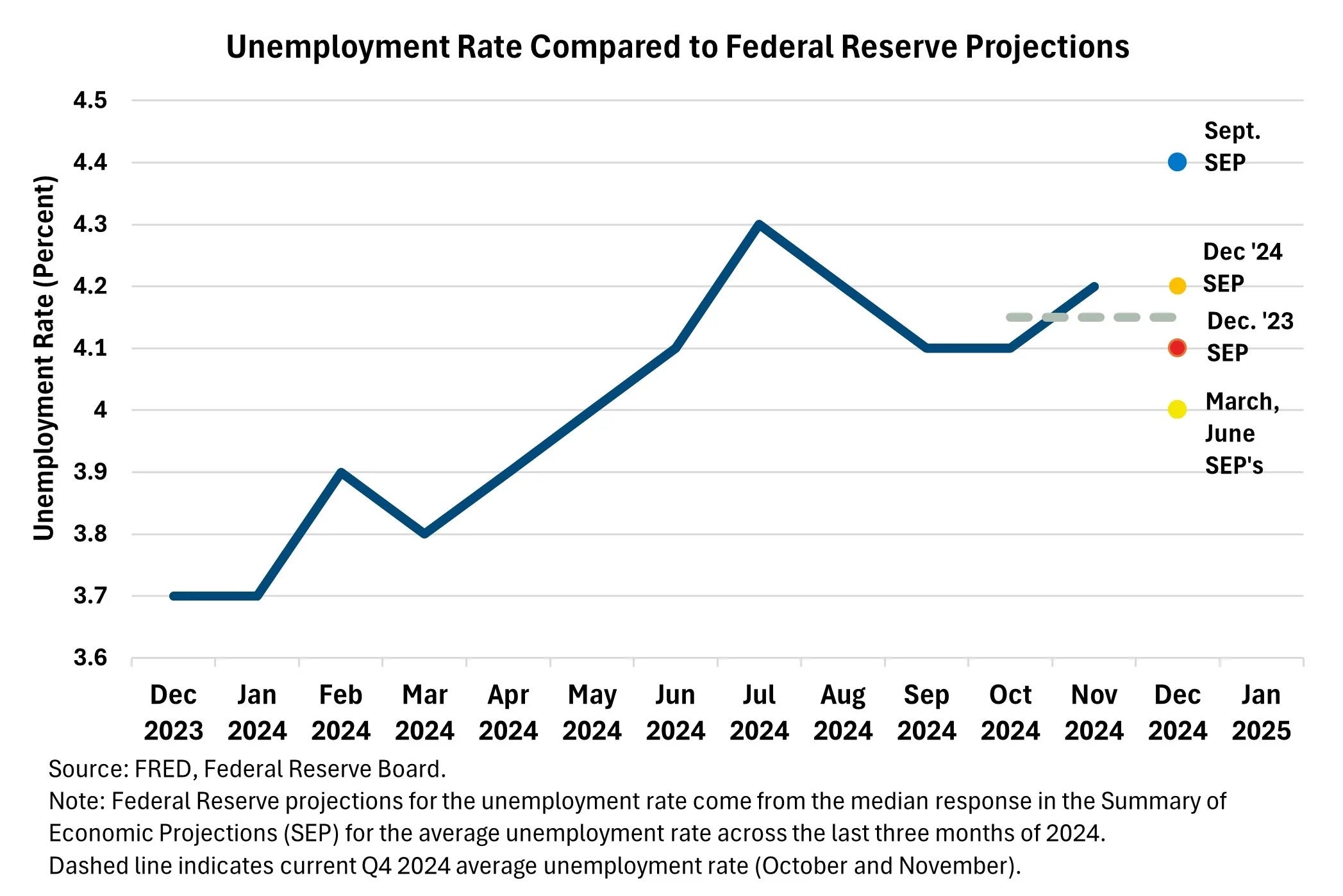

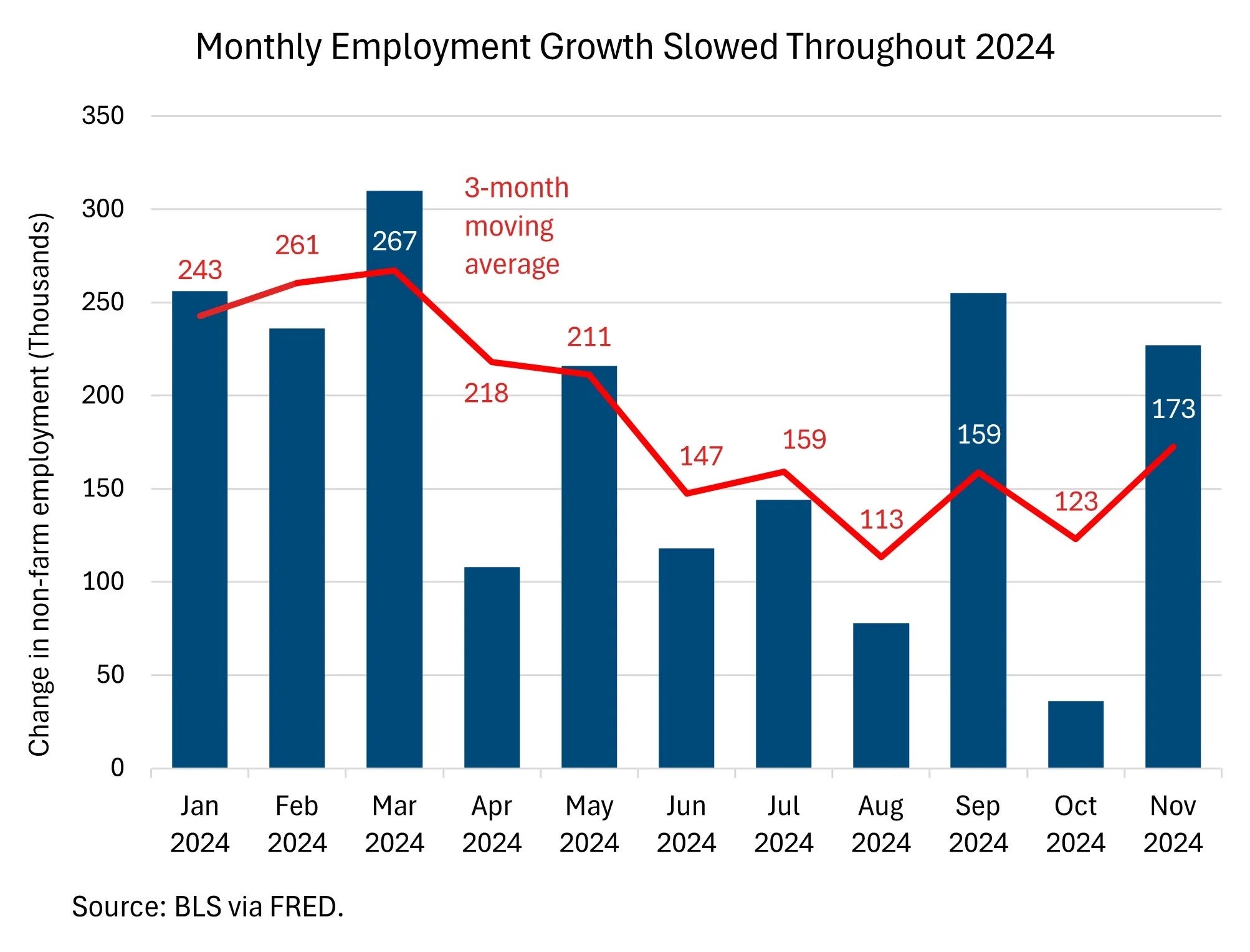

2. Despite heightened uncertainty, the labor market ended up close to where Fed officials predicted in December 2023.

2. Despite heightened uncertainty, the labor market ended up close to where Fed officials predicted in December 2023.